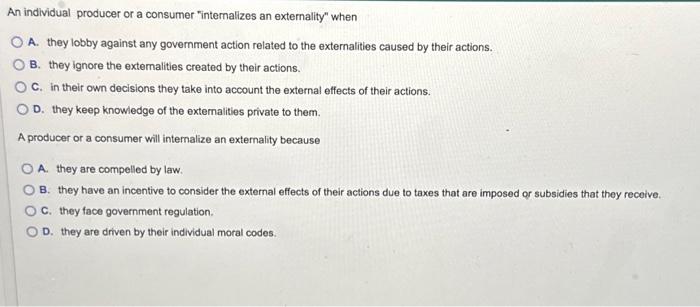

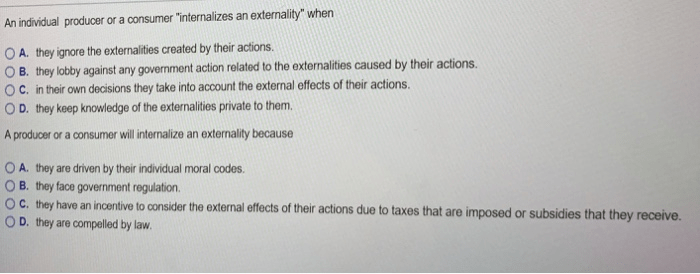

An individual producer or a consumer internalizes an externality when they consider the broader social costs or benefits of their actions, beyond their own private costs or benefits. This concept lies at the heart of addressing market failures caused by externalities, paving the way for efficient resource allocation and sustainable outcomes.

Understanding how individuals internalize externalities is crucial for policymakers, economists, and anyone interested in promoting economic efficiency and social welfare. This discussion explores the mechanisms through which producers and consumers incorporate externalities into their decision-making, highlighting the role of government interventions and the challenges involved.

Definition and Types of Externalities: An Individual Producer Or A Consumer Internalizes An Externality When

Externalities occur when the actions of one party impose costs or benefits on another party without compensation or payment. These costs or benefits are not reflected in market prices, leading to market failures. Externalities can be classified into two types:

- Positive externalities:Occur when the actions of one party generate benefits for another party. For example, education benefits society by creating a more skilled workforce.

- Negative externalities:Occur when the actions of one party impose costs on another party. For example, pollution from a factory harms the health of nearby residents.

Internalization of Externalities

Internalization of externalities occurs when the party responsible for generating the externality bears the full costs or receives the full benefits of their actions. This can happen through:

- Individual actions:Producers or consumers may voluntarily take steps to reduce or eliminate the externalities they generate, such as installing pollution control devices or purchasing eco-friendly products.

- Government interventions:Governments can use regulations, taxes, or subsidies to incentivize or discourage certain behaviors that generate externalities.

Property rights and market mechanisms can also play a role in internalizing externalities by clearly defining who has the right to use or benefit from a resource and by creating incentives for efficient use.

Individual Producer’s Perspective

A producer internalizes an externality by considering the costs and benefits of their production activities. They compare the marginal social cost (MSC), which includes both private and external costs, with the marginal private cost (MPC), which only includes private costs.

If MSC > MPC, the producer is generating a negative externality and should take steps to reduce it. This can be done through technological innovations, changes in production processes, or reducing output.

Individual Consumer’s Perspective

A consumer internalizes an externality by considering the costs and benefits of their consumption choices. They compare the marginal social benefit (MSB), which includes both private and external benefits, with the marginal private benefit (MPB), which only includes private benefits.

If MSB > MPB, the consumer is generating a positive externality and should consider increasing their consumption. If MSB< MPB, they should consider reducing their consumption to reduce the negative externality.

Government Interventions

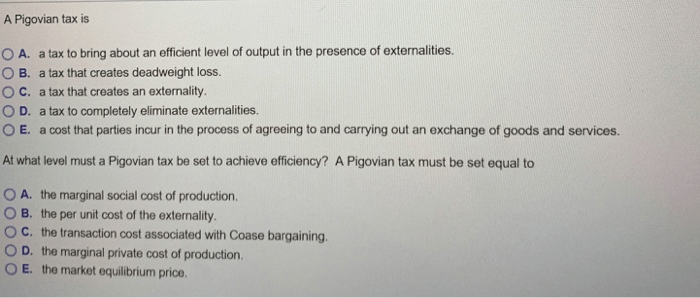

Governments can play a role in internalizing externalities through regulations, taxes, or subsidies. Pigouvian taxes and subsidies are specific policy tools designed to correct market failures caused by externalities.

- Pigouvian tax:A tax imposed on activities that generate negative externalities, such as pollution, to discourage those activities and internalize the costs.

- Pigouvian subsidy:A subsidy provided for activities that generate positive externalities, such as education, to encourage those activities and internalize the benefits.

Challenges and Limitations

Internalizing externalities can be challenging due to:

- Information asymmetry:One party may not have complete information about the costs or benefits of the externality, leading to inefficient outcomes.

- Enforcement costs:Monitoring and enforcing regulations or policies to internalize externalities can be costly.

- Distributional impacts:Internalizing externalities may have distributional consequences, such as higher prices or reduced output, which can impact different groups differently.

Weighing the efficiency and equity implications of internalizing externalities is crucial to ensure a fair and effective approach.

FAQ Corner

What is an externality?

An externality is a cost or benefit that arises from an economic activity and is imposed on a third party who is not directly involved in the activity.

How does an individual producer internalize an externality?

A producer internalizes an externality when they consider the social costs of their production, such as pollution, and take steps to reduce or eliminate those costs.

How does an individual consumer internalize an externality?

A consumer internalizes an externality when they consider the social benefits of their consumption, such as supporting local businesses, and make choices that promote those benefits.

What are the challenges of internalizing externalities?

Challenges include information asymmetry, enforcement costs, and distributional impacts. For example, it can be difficult to measure the social costs of pollution, and enforcing regulations can be costly.