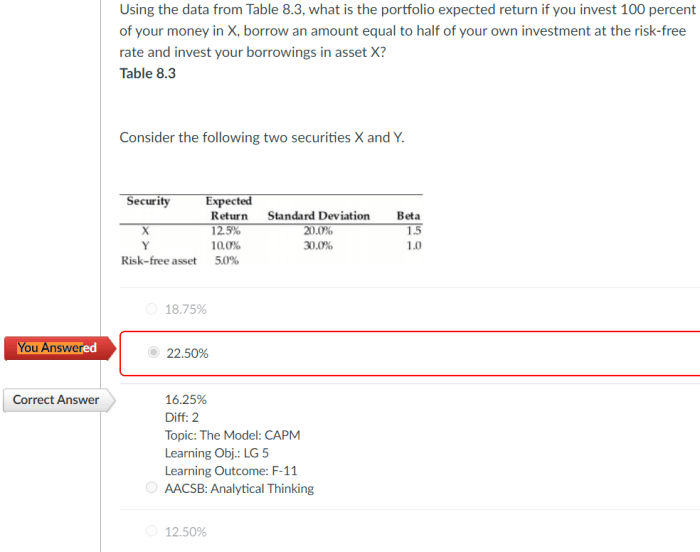

The expected return for an asset is 18.75 percent. This figure represents the average return that an investor can expect to earn from an investment in a particular asset over a given period of time. Expected return is a key concept in investment analysis and is used to compare different investment options and make informed investment decisions.

There are a number of factors that influence the expected return of an asset, including the asset’s historical performance, the level of risk associated with the asset, and the current market conditions. Investors should carefully consider all of these factors when making investment decisions.

Expected Return Definition: The Expected Return For An Asset Is 18.75 Percent

Expected return is a statistical measure of the average return on an investment over a given period of time. It is calculated as the weighted average of all possible returns, with the weights being the probabilities of each return occurring.

The expected return is influenced by a number of factors, including the risk of the investment, the time horizon, and the market conditions.

Historical Performance and Expected Return

Historical performance can be used to estimate future expected return. However, it is important to note that past performance is not a guarantee of future results.

For example, if an asset has historically returned 10% per year, this does not mean that it will continue to return 10% per year in the future. However, historical performance can provide some guidance as to what the expected return of an asset might be.

Risk and Expected Return

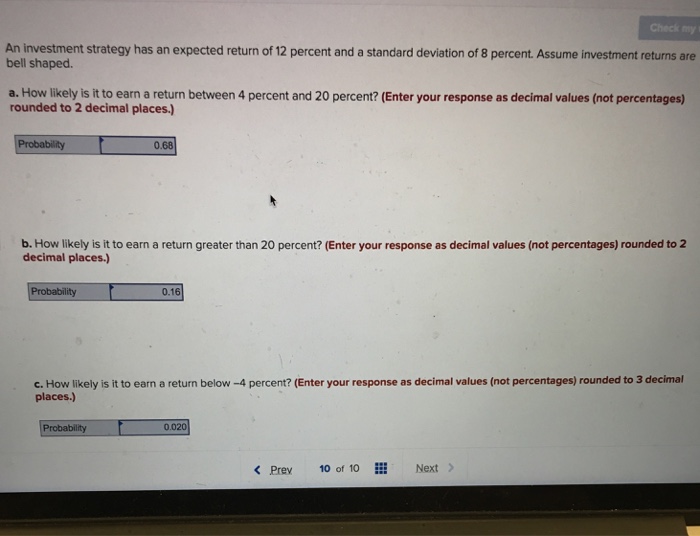

There is a positive relationship between risk and expected return. This means that, on average, investments with higher risk will have higher expected returns.

There are different types of risk that can affect the expected return of an asset. These include:

- Market risk

- Interest rate risk

- Inflation risk

- Currency risk

Market Conditions and Expected Return

Market conditions can also influence expected return. For example, during periods of economic growth, expected returns on stocks tend to be higher than during periods of economic recession.

Other market conditions that can affect expected return include inflation and interest rates.

Expected Return and Investment Decisions, The expected return for an asset is 18.75 percent

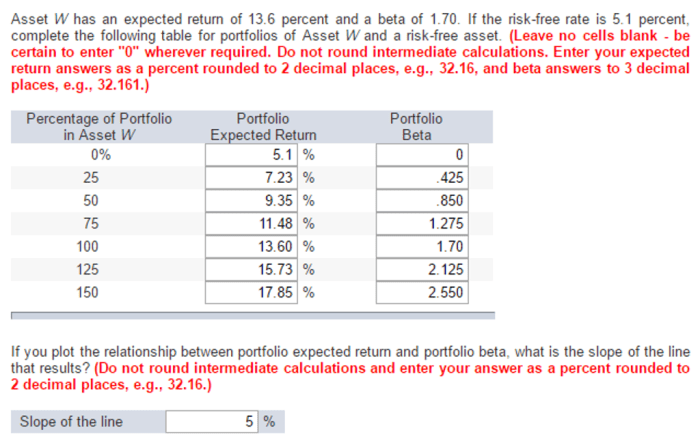

Expected return is an important factor to consider when making investment decisions. Investors should use expected return to evaluate the potential return of an investment relative to its risk.

For example, an investor might compare the expected return of a stock to the expected return of a bond. The investor would then choose the investment with the higher expected return that is appropriate for their risk tolerance.

Questions and Answers

What is expected return?

Expected return is the average return that an investor can expect to earn from an investment in a particular asset over a given period of time.

How is expected return calculated?

Expected return is calculated by taking the weighted average of the possible returns that an investment can generate, where the weights are the probabilities of each return occurring.

What are the factors that influence expected return?

The factors that influence expected return include the asset’s historical performance, the level of risk associated with the asset, and the current market conditions.